Estimated Tax Due Dates 2024 Quarterly Report

Estimated Tax Due Dates 2024 Quarterly Report. As the total price is above the funding. Making estimated tax payments on time has benefits beyond maintaining compliance.

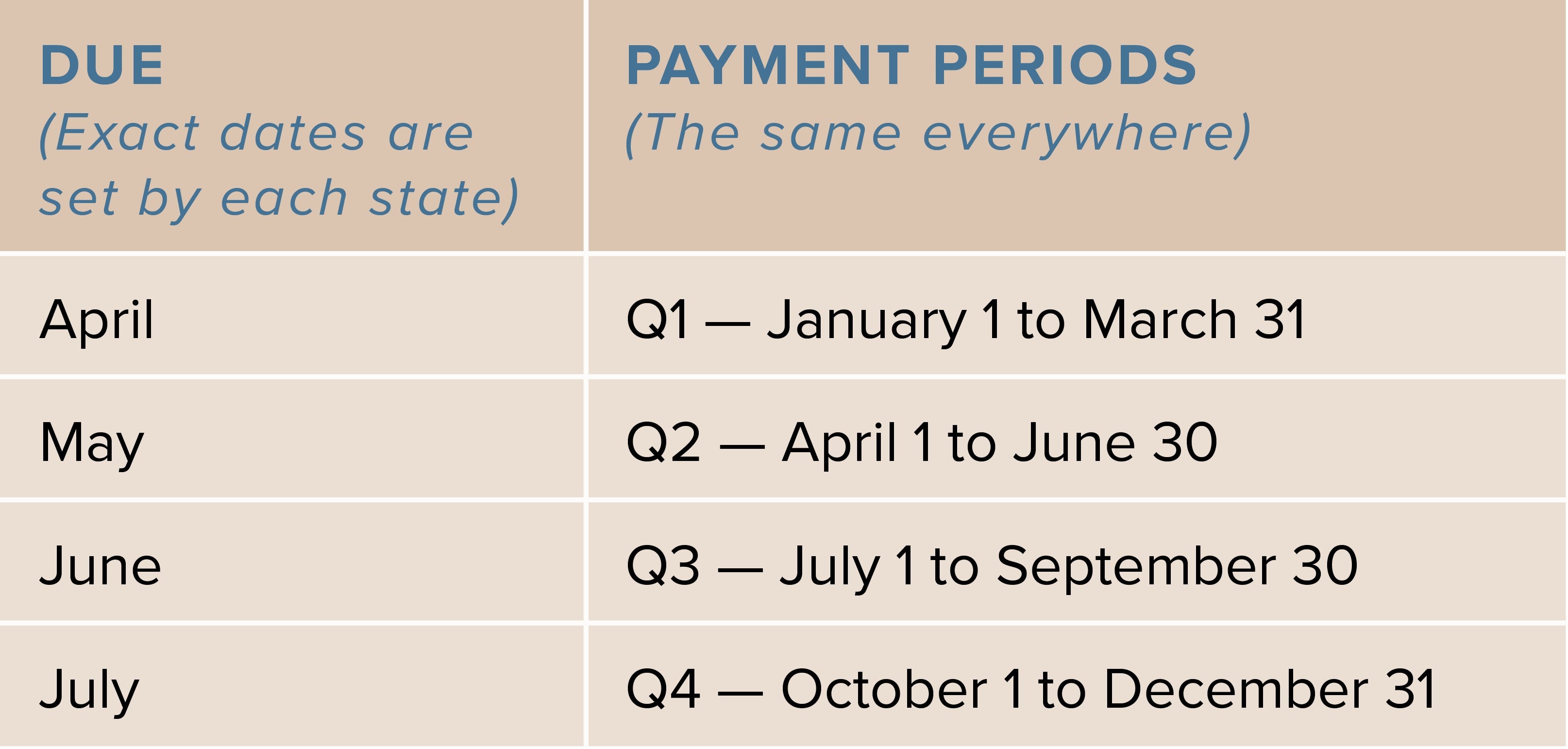

Estimated tax payments are typically made incrementally, on quarterly tax dates: The internal revenue service (irs) requires estimated taxes to be paid quarterly, but you have the flexibility to make these payments more frequently—weekly,.

Estimated Tax Due Dates 2024 Quarterly Report Images References :

Source: rosycorabella.pages.dev

Source: rosycorabella.pages.dev

2024 Estimated Tax Payment Due Dates Olia Felicia, We’ve put a simple guide together to help you navigate the forms and their related due dates.

Source: aleciaqyovonnda.pages.dev

Source: aleciaqyovonnda.pages.dev

2024 Quarterly Estimated Tax Due Dates And Dates Dede Monica, When are estimated quarterly taxes due?

Source: monahmorgen.pages.dev

Source: monahmorgen.pages.dev

Estimated Tax Due Dates 2024 For Corporations And Corporations Silva, 90% of the tax to be shown on their 2024 tax return or;

Source: juliannawblanca.pages.dev

Source: juliannawblanca.pages.dev

2024 Quarterly Tax Due Dates Cammy Corinne, You should submit your quarterly tax payments according to the following irs quarterly estimated tax timeline:

Source: sabramarika.pages.dev

Source: sabramarika.pages.dev

2024 Quarterly Estimated Tax Due Dates Aila Lorena, If you expect to pay $500 or more in taxes for the year, you need to make estimated tax.

Source: angeliquewnona.pages.dev

Source: angeliquewnona.pages.dev

2024 Quarterly Estimated Tax Due Dates And Dates Rowe Shelby, When are the quarterly estimated tax payment deadlines for 2024?

Source: austinewlibby.pages.dev

Source: austinewlibby.pages.dev

Irs Quarterly Payment Schedule 2024 heath conchita, If you skip these deadlines, you could trigger an interest.

Source: jyotiyregine.pages.dev

Source: jyotiyregine.pages.dev

2024 Quarterly Estimated Tax Due Dates Calendar Greer Karylin, We’ve put a simple guide together to help you navigate the forms and their related due dates.

Source: reynaphoebe.pages.dev

Source: reynaphoebe.pages.dev

Estimated Tax Due Dates 2024 Calculator Leela Margot, 15 of the following year, unless a due date.

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, 15 of the following year, unless a due date.

Category: 2024